Freemium to Premium: Feedback-Driven Conversion Strategies

Use targeted feedback collection to understand why free users don't upgrade, then address those barriers systematically. Convert more trials with data.

Summary

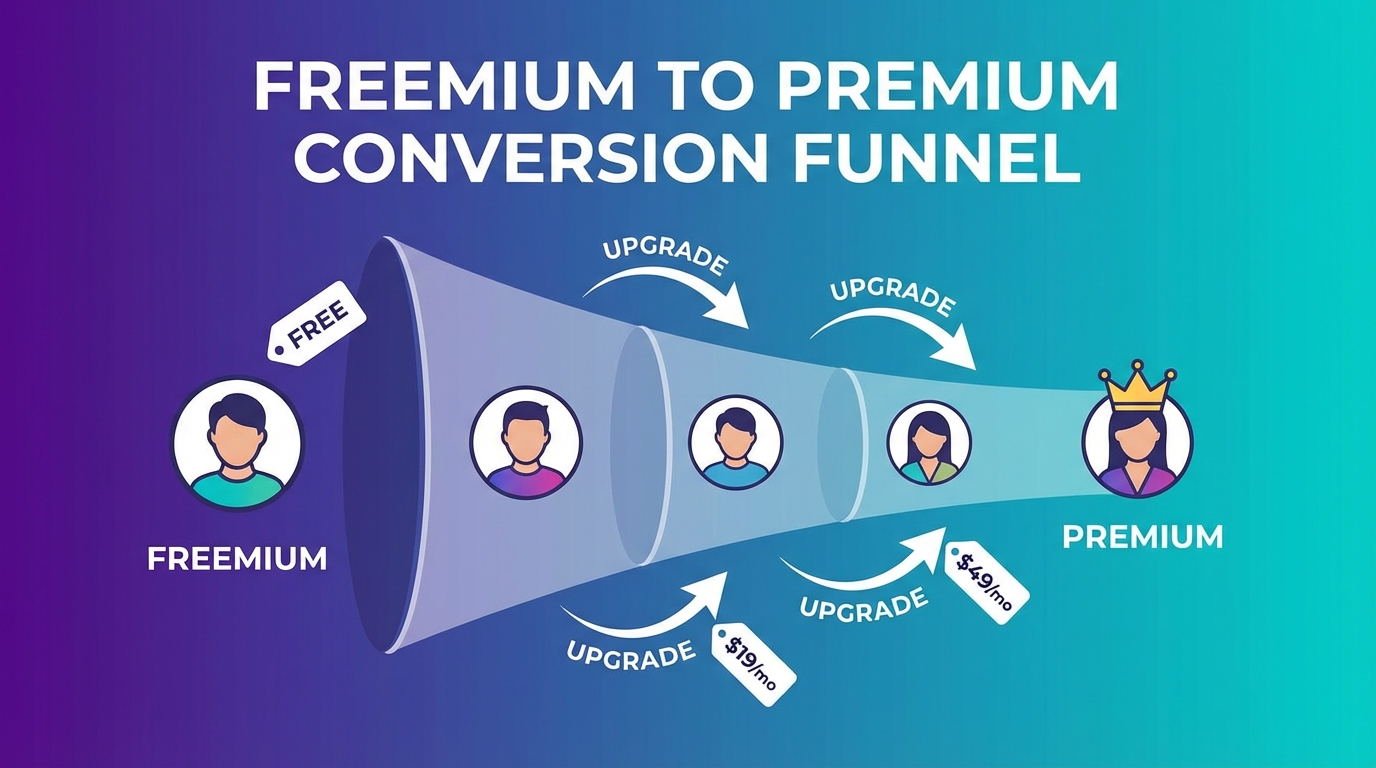

Freemium conversion rates typically hover between 2-5%, meaning 95%+ of free users never pay. Most teams guess at why users don't upgrade—price, features, timing, competition. Strategic feedback collection eliminates guessing by revealing the actual barriers to conversion. This guide covers how to collect, analyze, and act on feedback to systematically improve freemium-to-premium conversion.

Understanding the Freemium Conversion Problem

The freemium model creates a unique challenge: you have users, engagement, even satisfaction—but no revenue from most of them. Understanding why requires distinguishing between different types of non-converters.

The Non-Converter Taxonomy

Not all free users are equal. Categorizing them helps target your feedback efforts:

| Segment | Behavior | Conversion Potential |

|---|---|---|

| Value Extractors | Heavy usage, no intent to pay | Low |

| Evaluators | Moderate usage, comparing options | High |

| Satisfied Free | Light usage, needs met by free tier | Medium |

| Confused | Minimal usage, unclear on value | High |

| Wrong Fit | Tried and found product unsuitable | None |

Feedback strategies differ for each segment. Evaluators need friction removal. Confused users need clarity. Satisfied free users need motivation to want more.

The Conversion Timing Problem

Freemium conversion often fails because upgrade prompts come at wrong moments:

- Too early: User hasn't experienced enough value

- Too late: User has established "free" as acceptable

- Wrong context: Prompt during frustration rather than success

Feedback helps identify the right moments by revealing when users feel value most intensely.

Strategic Feedback Collection Points

Capturing conversion-relevant feedback requires placing surveys at moments when users can articulate their decision-making process.

Feature Limit Encounters

When users hit free tier limits, they're actively experiencing the boundary between free and paid. This is prime feedback territory.

At limit encounter, ask:

- "Would this feature be valuable enough to upgrade for?"

- "What's holding you back from upgrading right now?"

- "What would make upgrading a no-brainer?"

Best practices:

- Don't ask immediately—wait until they've tried the workaround

- Offer the feedback survey as an alternative to upgrading

- Track which limits generate upgrade interest vs. frustration

Usage Milestones

Certain usage thresholds indicate serious engagement. Users who've created 50 projects, invited 5 team members, or logged in 30 days straight are invested. Their feedback about upgrading is particularly valuable.

Milestone survey questions:

- "You've been using [product] actively. What keeps you on the free plan?"

- "If you were to upgrade, what feature would be most valuable?"

- "Is there anything about our paid plans that gives you pause?"

Trial Expiration Windows

If your freemium includes a premium trial, the days before and after expiration are critical feedback moments.

Pre-expiration (3-5 days before):

- "How has your trial experience been?"

- "What would convince you to continue with premium?"

Post-expiration (immediately after):

- "What led to your decision not to upgrade?"

- "Was there anything missing from the premium features?"

Post-expiration (7-14 days later):

- "Now that you're back on free, what do you miss most?"

- "What would change your mind about upgrading?"

Cancellation and Downgrade Moments

Users who had premium and returned to free provide crucial insights about value perception and price sensitivity.

Downgrade survey questions:

- "What's the main reason you're moving to the free plan?"

- "Was there a specific feature that wasn't worth the cost?"

- "Would a different pricing option have kept you on premium?"

Designing Surveys That Reveal Conversion Barriers

Generic surveys generate generic insights. Surveys designed specifically for conversion insights go deeper.

The "Why Not Now" Framework

When a user declines to upgrade, don't just accept the "no." Understand it:

Question sequence:

-

"What's the main reason you're not upgrading today?" (Multiple choice)

- Too expensive

- Don't need premium features

- Not the right time

- Need to discuss with team

- Evaluating alternatives

- Other

-

Conditional follow-up based on response:

- If "too expensive": "What price would feel right for the value you'd get?"

- If "don't need features": "Which premium feature would be most valuable if you could have just one?"

- If "not the right time": "When would be a better time? What would change?"

- If "need to discuss": "What concerns do you think your team would have?"

Value Perception Surveys

Understanding how users perceive value helps position premium more effectively.

Value survey questions:

- "On a scale of 1-10, how valuable is [product] to your work?"

- "Which feature do you use most?"

- "What would make [product] twice as valuable to you?"

- "How much time does [product] save you per week?"

Correlate these responses with conversion rates to identify which value perceptions predict upgrades.

Competitive Intelligence Gathering

Non-converters often have context about alternatives that helps you position premium better.

Competitive feedback questions:

- "What other tools are you considering or using for this?"

- "How does our premium compare to alternatives you've seen?"

- "What would make you choose us over [competitor]?"

Analyzing Conversion Feedback

Raw feedback becomes actionable through systematic analysis.

Building a Conversion Barrier Index

Rank barriers by frequency and addressability:

| Barrier | Frequency | Addressable? | Priority |

|---|---|---|---|

| Price too high | 35% | Partially | High |

| Missing feature X | 22% | Yes (roadmap) | High |

| Free tier sufficient | 18% | Partially | Medium |

| Need team approval | 15% | Yes (materials) | High |

| Evaluating competitors | 10% | Yes (positioning) | Medium |

Focus on high-frequency, addressable barriers first.

Segment-Specific Analysis

Different user segments have different barriers. Analyze feedback by:

- Company size: Enterprises vs. SMBs vs. individuals

- Use case: Different workflows have different value perceptions

- Acquisition channel: Organic vs. paid vs. referral

- Geography: Price sensitivity varies by region

- Engagement level: Heavy users vs. casual users

Trend Analysis

Track barrier frequency over time. After launching a new premium feature, does "missing feature X" decline as a barrier? After adjusting pricing, does "too expensive" become less common?

Monthly trend tracking:

- Plot top 5 barriers over 6+ months

- Correlate with product/pricing changes

- Identify seasonal patterns

Acting on Conversion Feedback

Insights drive improvement only when translated into action.

Quick Win Responses

Some feedback points to immediate fixes:

Barrier: "Not sure what premium includes" Fix: Improve premium feature communication on pricing page

Barrier: "Can't justify cost to manager" Fix: Create ROI calculator and business case template

Barrier: "Don't want annual commitment" Fix: Add monthly pricing option (even at premium)

Product Roadmap Inputs

Feature-related feedback should inform product priorities:

- Track "missing feature" mentions by specific feature

- Estimate revenue impact: (mentions × conversion value × conversion probability)

- Balance against development effort

- Communicate roadmap to waiting users

Pricing Strategy Adjustments

Pricing feedback requires careful interpretation:

- "Too expensive" doesn't always mean lower prices—sometimes it means better value communication

- Consider tier restructuring before price reduction

- Test annual vs. monthly pricing based on commitment feedback

- Explore usage-based pricing if "paying for unused features" appears frequently

Sales Enablement

Feedback reveals what sales conversations should address:

- Create objection-handling guides based on common barriers

- Develop case studies targeting specific concerns

- Build comparison content addressing competitive mentions

- Train sales on barrier-specific responses

Automating Feedback-Driven Conversion

Scale your insights with automation.

Trigger-Based Surveys

Deploy surveys automatically when:

- User hits upgrade prompt 3+ times without converting

- User's usage suggests they'd benefit from premium

- User returns after premium trial lapse

- User mentions competitor in any interaction

AI-Powered Analysis

Natural language processing can categorize open-ended responses automatically:

- Sentiment detection on upgrade-related feedback

- Theme extraction from free-form responses

- Trend detection and alerting

- Anomaly identification (sudden barrier spikes)

Personalized Upgrade Messaging

Use feedback to personalize upgrade prompts:

- User mentioned "team collaboration" → highlight team features

- User concerned about "price" → emphasize ROI and time savings

- User interested in "feature X" → lead with that feature in upgrade CTA

Measuring Feedback Program Impact

Track whether your feedback program improves conversion.

Primary Metrics

- Freemium conversion rate: The ultimate measure

- Barrier resolution rate: Percentage of identified barriers addressed

- Time to upgrade: Does feedback-informed nurturing accelerate conversion?

Secondary Metrics

- Feedback response rates: Indicates survey quality

- Insight actionability: What percentage of feedback leads to changes?

- Feedback-driven test success rate: Do feedback-informed experiments win more?

Attribution Challenges

Conversion improvement has many causes. Isolate feedback program impact by:

- Running controlled experiments with feedback-driven changes

- Tracking conversion changes after specific barrier resolutions

- Comparing conversion rates between surveyed and non-surveyed cohorts

Common Pitfalls

Survey Fatigue Among Free Users

Free users aren't paying—respect their attention more carefully:

- Limit surveys to once per month maximum

- Make surveys genuinely brief (one question ideal)

- Offer value in exchange (tips, extended trials, etc.)

Optimizing for Feedback Instead of Conversion

Don't let feedback collection become the goal. The goal is conversion. If surveys annoy users into churning, you've failed regardless of insight quality.

Taking Feedback Too Literally

"Make it free" isn't actionable feedback. "Too expensive" might mean "I don't understand the value." Interpret feedback through business context.

Ignoring Successful Converters

Non-converter feedback is valuable, but converter feedback reveals what works. Survey new premium users to understand what tipped them over:

- "What finally convinced you to upgrade?"

- "What would have gotten you to upgrade sooner?"

Key Takeaways

- Segment non-converters: Different user types need different approaches

- Time surveys strategically: Limit encounters, milestones, and expirations are prime moments

- Go deep on "why not now": Surface barriers with conditional follow-ups

- Quantify barriers: Track frequency and addressability to prioritize

- Close the loop: Every barrier insight should drive a specific action

- Measure program impact: Tie feedback efforts to conversion rate improvements

User Vibes OS identifies conversion barriers through AI-analyzed feedback and triggers personalized upgrade nudges. Learn more.

Related Articles

Landing Page Optimization Through Visitor Feedback

Learn how micro-surveys and exit intent feedback can dramatically improve landing page conversion rates. Data-driven optimization beyond A/B testing.

Pricing Feedback Without Asking About Price: Indirect Signals That Reveal Willingness to Pay

Learn how to gauge price sensitivity through feature prioritization, value-first framing, and behavioral signals without asking users about price directly.

Building a Public Roadmap That Builds Trust (Without Overpromising)

Learn how sharing your product roadmap reduces support tickets, builds customer trust, and creates product advocates—while managing expectations and avoiding the overpromising trap.

Written by User Vibes OS Team

Published on January 15, 2026